Bob has Masters degrees in Environmental Policy (1981) and Environmental Engineering (1996 ) from LSU. Coping with climate change is a hot topic with a bearing on everyone's lives these days. In this video, Bob Jacobson frames the debate, clarifies the real likelihood of the "1 in a thousand-year flood" in human terms, spotlighting true mitigation, i.e. insuring for the dollar risk of flood events to allow the capacity to recover. He doesn't mince his words. Evacuation is the primary response to flood risk. Government evacuation orders are there to help save lives not real estate property, insure the property for your recovery. Over the next decade we'll see major changes in the handling of risk and mortgages will include flood insurance. Levees and other engineering works should be regarded as insurance cost reduction measures, not hurricane protective measures. Bob identifies and clarifies the five tenets of flood risk in dollar terms. Ri$k.

The principle of buyer beware applies to property and owners / prospective owners. We should apply due diligence. Insurance is our best way to mitigate flood risk to enable property recovery. Owners must calculate their own flood risk, he says, and explains why the National Flood Insurance Program is not really fit for purpose. He asks the government to: 1. Adopt five tenets of 21st Century Flood Risk Wisdom. Educate officials, media and public to abandon foolish approaches. He says the National Flood Insurance Program (NFIP) is not supporting due diligence - please stop subsidizing excessive risk-taking, please stop over-pricing modest risk exposure. He says the NFIP is not supporting resiliency - there's a massive uninsured population, and damages are worsening with climate change and equity and justice issues are very apparent. We must try to be fair and avoid sub-optimal mitigation decisions. 2. Help modernize the Standard Operating Procedure for property transaction due diligence and support an online tool for pricing every property's flood risk. Accelerate our ability to accurately define the expected annual cost of flood risk for our property, the present value 3. Update 8 ultra-high resolution geospatial data 4.Continuously improve change forecasts 5.Properly regulate flood insurance markets 6. Broaden participation in good flood insurance No mortgaged property should be uninsured for the "30-year snake-eyes chance flood". He argues that flood risk is commonly underestimated, in a hypothetical family of 12 siblings, each living for 80 years, distributed widely, he says one of them has a 1 in 12 chance of experiencing a 1-chance-in-1,000-per-year-chance flood (snake-eyes). 7. Promote only sensible public projects and programs for mitigating flood risk. Don't waste tax dollars mitigating a flood risk that is cheaper for property owners to insure. 8. There are equity and justice issues regarding property, historically marginalized people may need assistance with their flood insurance. 9. Promote no adverse impact on floodplain capacity flood storage and flood conveyance. Don't increase flood risk pricing for other communities or neighbors (public & private projects). Don't place all burden on new development. Consider a uniform run-off tax. Drainage improvement and levees are useful. Also floodplain roads and bridges. Clearing ditches and culverts can help protect the lowest guy on the block. 10. Separate flood plain ecosystem restoration from sensible flood risk mitigation. They are both equally valid but distinct public objectives (by treating these separately you will likely get the best options for both goals). In Ecosystem restoration projects, please optimize for habitat In flood risk mitigation$ please optimize for flood insurance cost reduction and ensure that the insured owner beneficiaries contribute to the cost. Bob expands upon each area of his talk in the separate videos below:The eight videos links and associated credit hours are:

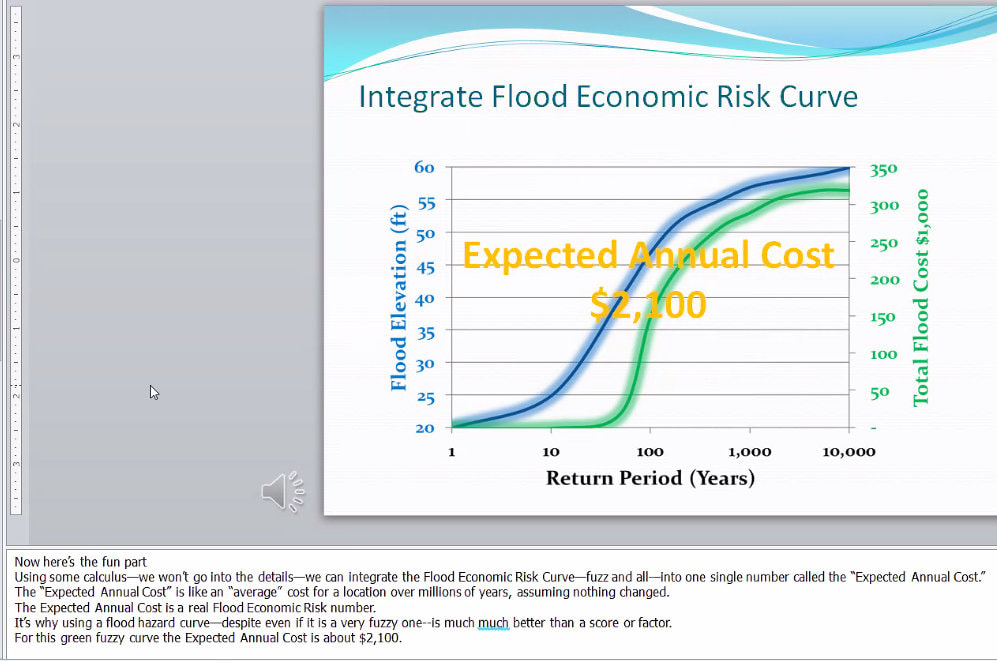

The Five Tenets of 21st Century Flood Ri$k Wisdom—Introduction (0.1 hr) https://www.youtube.com/watch?v=KI1COouFhVc 21st Century Flood Ri$k Wisdom Tenet 1—Flood Exposure is Location-Specific (0.1 hr) https://www.youtube.com/watch?v=rmDWa0qxANg 21st Century Flood Ri$k Wisdom Tenet 2—Flood Hazard is a Mathematical Curve (0.3 hr) Very important! https://www.youtube.com/watch?v=yqa_4exx1EM 21st Century Flood Ri$k Wisdom Tenet 3—Flood Risk is a Present Value (0.2 hr) https://www.youtube.com/watch?v=G9hHVmzTQ3E 21st Century Flood Ri$k Wisdom Tenet 4—Due Diligence is Pricing Risk (0.1 hr) https://www.youtube.com/watch?v=HIfYxuJEn9g 21st Century Flood Ri$k Wisdom Tenet 5—Resiliency is Good Insurance + Sensible Mitigation (0.1 hr) https://www.youtube.com/watch?v=Wx-BDS06iuU Technology is Making 21st Century Flood Ri$k Wisdom a Reality (0.3 hr) https://www.youtube.com/watch?v=6td8O4t6UaM Ten Wise Policies for Flood Risk Management (0.1 hr) https://www.youtube.com/watch?v=P3QWhgcB-zY Plus: Email Questions/Comments (0.2 hr) Total Credit Hours 1.5 hours. More if you re-watch the trickier bits. We are very grateful to LMNGBR and to Bob Jacobson for his interesting presentations.

0 Comments

Leave a Reply. |

LMNA News BlogWelcome to the Louisiana Master Naturalist Association News Blog. Archives

April 2024

Categories |

Search by typing & pressing enter

RSS Feed

RSS Feed